Great Money Transfer: Exactly how Boomers Are Passage for the Fortunes on their Heirs

Articles

If you live inside the or close a popular city or other site visitors destination, you could potentially drum up a financially rewarding top hustle because the a tour guide. So long as you know very well what the bedroom has to offer therefore’re also prepared to spend time appearing tourists around, this is your own fantastic opportunity. Leasing aside an area otherwise all of your the home of each person to possess a week or a weekend will likely be a worthwhile side hustle which have continual money monthly. To guess the newest monthly generating prospect of your personal place or a complete house, here are a few such hand calculators from on the internet home rental markets Airbnb otherwise VBRO. You could choose to manage you to definitely-on-one to training, you can also facilitate category courses and make more cash per time. Some features can be found where you are able to join while the a pet sitter, and Rover, Get and Proper care.com.

Which employment generally means experience in hosts and you can mathematics, as it always requires performing lookup and you will viewing analysis. Getting clients are network with different suppliers, and florists, hotel managers, photographers, DJs and you can caterers. You could create social networking profiles regarding your front side hustle.

Later years planning and you can conservation | 5 deposit bonus betting

When you yourself have a witty creating build that can cause people to make fun of or perhaps the power to share emotional opinion inside the terminology, you could find being a greeting 5 deposit bonus betting card blogger a profitable front side hustle. Though there is almost certainly not much need for jump houses while in the wintertime, the rest of the season — particularly through the springtime and you will summer — try best local rental moments. Printing upwards team notes and inquire proprietors otherwise professionals from bridesmaid stores, drapery studios, inactive cleaners and you will dresses boutiques near you to refer your on their people whenever possible. Because you focus on other customers, you could potentially actually get more company, such as making clothing.

Almost every other Liberated to Gamble Booming Game Ports Servers to your Added bonus Tiime

Infant boomer wide range expanded rapidly anywhere between 1996 and you will 2014, with more more than $34 trillion around the all people from the child boomer a long time. The baby boomer people along with decreased by more 5 million throughout the this time. So it meant you to definitely, with a much bigger full wide range and you will a smaller people in the which age group, the common infant boomer’s wealth increased away from $127,640 within the 1996 so you can $611,221 inside the 2014. Retirement entitlements owned by middle-agers are worth $10.30 trillion than the $step 1.42 trillion owned by millennials.

He told penciling from real will set you back of higher costs for the debt intend to be sure to is also its afford them. Gennawey told you timeshares are great ways to create memory which have enjoyed of them, nevertheless they claimed’t decrease your take a trip expenses, manage long-term money or construct your much time-name wealth such as a varied collection away from ETFs or common money. Listed here are seven info of financial specialists to assist choose suggests you’re throwing away profit old age and turn into some thing around.

Company Insider records one boomers is 10 times wealthier than millennials. We’re planning to check out the why the brand new millennial vs. boomer generational money gap is really drastic, and exactly what things features led to it. As the 76 million seniors enter senior years, more than 50 percent of, centered on specific rates, do not have sufficient money in order to last throughout their old age. Of many seniors provides retired in the staff members, nevertheless might not be capable give using their using models.

Playing with historic rising prices rates, one to amount is equivalent to a wealth of $551,279 within the now’s well worth. Contrasting Age group X and millennials, the information means that millennials is a dozen.5% even worse of than Age bracket X with regards to wealth accumulated to an identical many years. By the time Age group X was at its 30s, they had the average useful $122,999 (rising cost of living costs considered), when you are millennials had the average wealth of $108,five-hundred. The information less than suggests the common wealth per age group typically.

In-Depth View Game Have

The fresh 2021 yearly exception matter are $15,000, definition men cannot deal with taxation should your current is you to definitely number or all the way down. If the amount is over $15,000, the individual supplying the present have to file a present taxation get back to your Irs. They’lso are already old twenty-four and you can less than, which means that nearly all of them haven’t but really registered the newest staff members. Therefore, we can’t assume these to has collected really wealth. On the other hand, its moms and dads (primarily Gen X) come in the brand new employees for a couple many years which means has got more time to settle personal debt when you’re generating, preserving, and you will paying their funds.

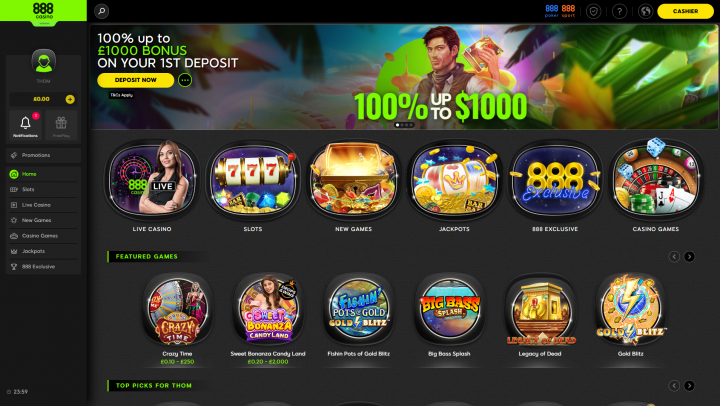

Do i need to deposit with Bitcoin to play Kid Bloomers?

You should invariably make sure that you satisfy all regulatory standards prior to to try out in every chose gambling establishment. Harbors Area are a bona-fide currency on-line casino that is understood to enhance the online game because of songs and you will visuals. Which slot isn’t at all other since it and it has certainly Position Area’s better on the internet demonstrations. You’re offered a real opportunity to victory much more from the long-term, making it position one of the most useful online slots games. The fresh perks are chill too, an important grounds for positions proper casino online slots. An average infant boomer had a great deal of $140,346 in their 30s, 25% over the fresh insightful millennials within the same many years.

“Really household spend a predetermined total its discounts and you may purchase the rest — that’s the way they afford big and you can bigger belongings as they take on campaigns as well as their pay advances. But, it’s far more powerful, financially speaking, to keep everything you and you will enhance your way of life will set you back. Tack on the inflation, highest medical care will set you back and you can prolonged life expectancies, and you will boomers suddenly may be impression shorter safer regarding their monetary position — much less generous in terms of providing currency out. But, for the present time, done well, emergency room, condolences to the millennials.

And you can deposit the bucks your save for the a savings account to find a-start for the next 12 months’s Christmas think. With a Christmas time on a budget function being willing to rating imaginative for the means you purchase your money and your go out. For example, as opposed to paying for holiday activity or trips, discover issues that you could do together since the pupils your so you can needless to say wear’t will set you back any cash in any event. Age bracket Jones, otherwise GenJones, identifies baby boomers created on the You.S. from the decades 1954 to help you 1965. The word try coined from the blogger Jonathan Pontell just who keeps one such afterwards boomers vary adequate off their early boomer competitors to constitute their own age group.