Bookkeeping for Restaurant Owners: A Comprehensive Guide

These costs are expenses that do not directly contribute to your business’s production and sales but support it as a whole. This includes things like your restaurant’s digital signage, printing out the menu and window decals, and even marketing your restaurant business online. Simplifying your restaurant’s bookkeeping process means efficiently managing the daunting task of settling salary https://www.bookstime.com/ payments, especially if you’re running huge operations and managing many employees. Regardless of how complex bookkeeping can look like in the beginning, understanding the basics is not an impossible task. Here is an in-depth restaurant bookkeeping guide to help you navigate this essential business process. Bookkeeping is one of the most essential aspects of any restaurant business.

Accounts Payable

Once uploaded, Shoeboxed categorizes and organizes your scanned receipts into tax or custom categories so you can see where your money is going and claim deductions during tax time. Receipts are also converted into a searchable database so you can find any receipt when needed. You’ll also want to triple-check that taxable items reflect the correct state and local sales tax so that you collect the correct amount from customers. It’s surprisingly easy to overlook the tax settings when you enter new menu items. So, take extra care to ensure you always have the correct amount on hand when your tax bill comes due.

How your POS complements your accounting

A chart of accounts makes it easier to locate specific accounts to identify trends, generate accurate financial statements, and make improvements. The accounts payable process is a crucial component of restaurant bookkeeping, influencing your relationships with how to do bookkeeping for a restaurant suppliers and your restaurant’s financial stability. Implementing efficient accounts payable practices involves meticulous record-keeping, setting clear payment terms with suppliers, and utilizing digital tools for invoice processing and payment automation.

What is the difference between bookkeeping and accounting?

With such tight profit margins in the restaurant industry, it is important to analyze your financial reports on a regular basis. Restaurants should be looking at sales vs. cost of goods sold ratios as well as labor ratios. Another ratio many restaurants should consider is the prime cost, which aims to keep the cost of food + beverage + labor at roughly 60% to 65% of your total sales. Whether you’re running the accounting services yourself or outsourcing your restaurant accounting, staying on top of the day-to-day bookkeeping is essential to stay ahead of your competition and turn a profit.

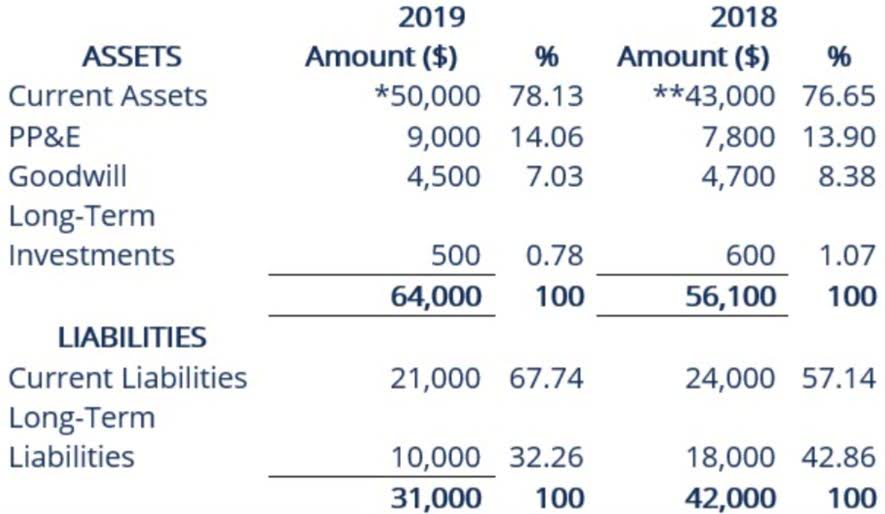

Meanwhile, cash flow statements offer an intricate perspective on the inflow and outflow of cash within your restaurant, helping you manage fixed costs efficiently. Running a restaurant is a dream for many, but it comes with its fair share of challenges, particularly in the financial realm. Proper bookkeeping for restaurant owners is essential for the success and longevity of your business. It lists all the accounts you use to record your financial transactions, such as assets, liabilities, revenue, costs, and owner’s equity. Each account is assigned a unique number and name, and transactions are recorded under the appropriate account.

- This allows you to track your income and expenses in a structured manner and generate accurate financial reports.

- Keep the original receipts so that if you encounter any problems down the road, you have supporting evidence to go back to.

- Explore the benefits of restaurant accounting software and how it can simplify your financial management.

- The level of liability for restaurant owners doing payroll on their own can be very high because filing the payroll taxes incorrectly or late can lead to steep penalties.

- Reconciling accounts keeps you aware of lost checks, incorrect deposits, or cash variances.

- It’s a practice that aligns closely with accurate COGS calculations and, when combined, can significantly enhance your restaurant’s profitability and sustainability.

Simplify accounting for restaurants with QuickBooks so you focus on the food while getting more accurate results. The last step is analyzing your financial data to budget and plan for the future. Plan to analyze your financial data weekly and for each period, and work with your accountant (if you have one) to set financial goals and develop strategies to achieve them. You can rest assured that we will work closely with you to create actionable business plans and accurate financial reporting. We offer our toolkit of financial intelligence that will be your greatest asset for business growth.

- Most restaurant POS systems will have a daily sales summary built into them.

- You should also segregate your cash sales and those made using credit cards.

- Overhead rates are the monthly fixed costs it takes to run your business.

- Record a separate daily sales entry for each day (not monthly or weekly).

- Regularly analyzing your restaurant’s financial and operational data is crucial for restaurant bookkeepers to help the business maintain a healthy bottom line.

Restaurant accounting methods to choose from

Using the wrong accounting method